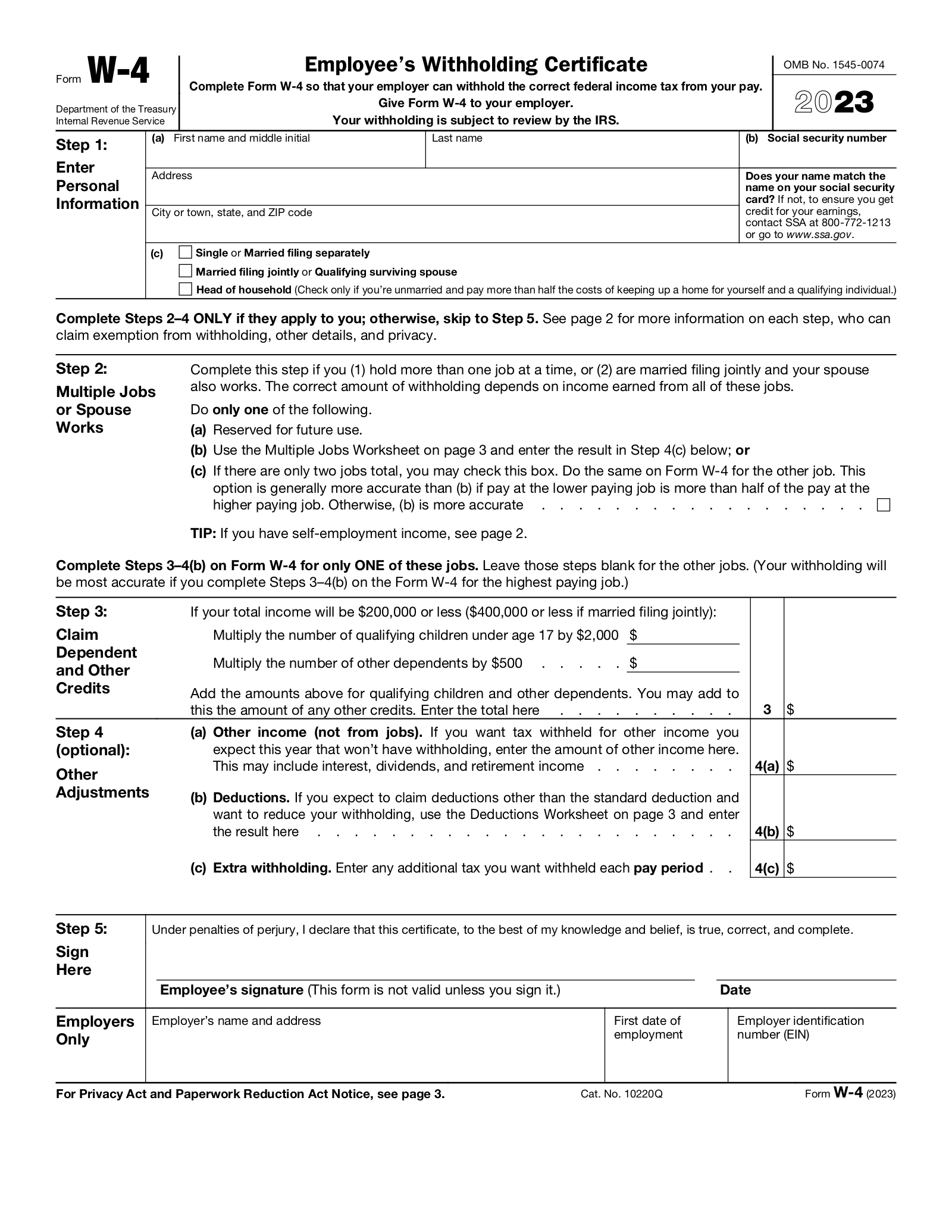

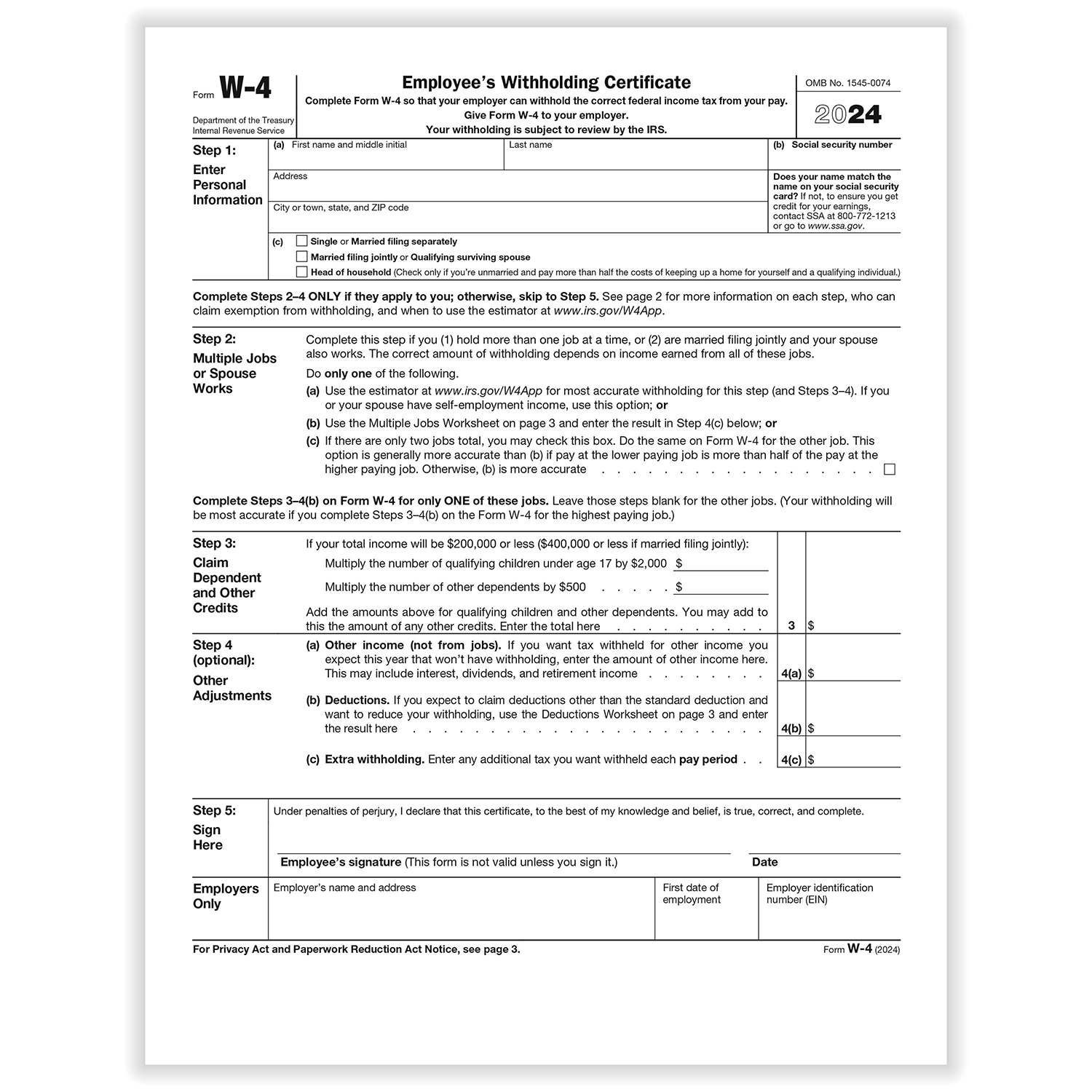

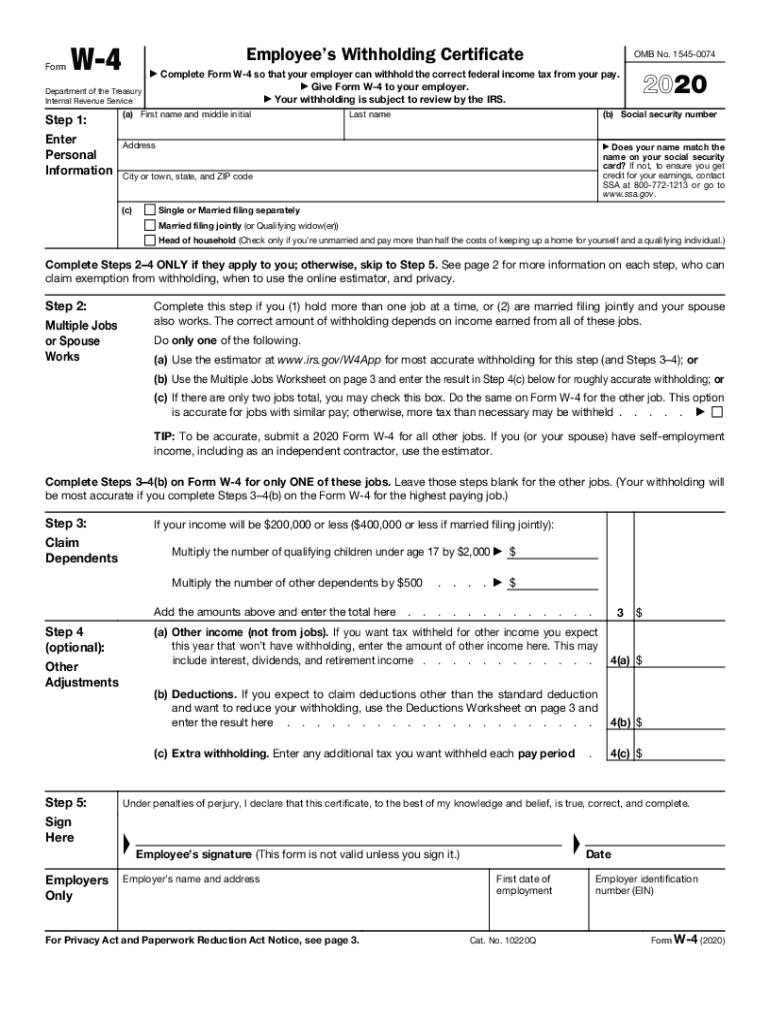

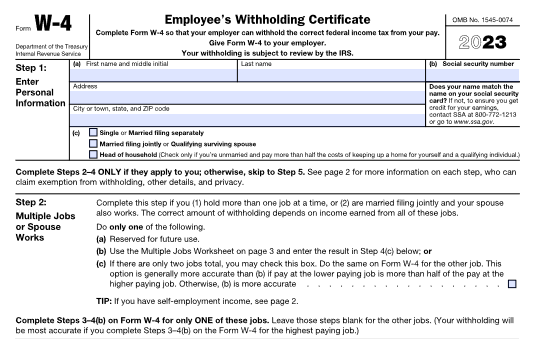

Printable Form W-4 2024 Irs – The IRS recently released an updated version of Form W-4 for 2024, which can be used to adjust withholdings on income earned in 2024. The main difference between the 2023 and 2024 W-4 is Step 2. . As of 2024, employers and employees each pay 6.2% for Social taxes properly based on how much the employee makes and how they fill out their W-4 form. State payroll tax rates vary. However, the .

Printable Form W-4 2024 Irs

Source : www.irs.govFree IRS Form W4 (2024) PDF – eForms

Source : eforms.com2024 Form W 4P

Source : www.irs.gov2024 IRS W 4 Form | HRdirect

Source : www.hrdirect.comFree IRS Form W4 (2024) PDF – eForms

Source : eforms.comIRS Releases 2024 Form W 4R | Wolters Kluwer

Source : www.wolterskluwer.comForm W 4 2023 (IRS Tax) Fill Out Online & Download [+ Free Template]

Source : www.pandadoc.comPublication 505 (2023), Tax Withholding and Estimated Tax

Source : www.irs.govFillable w4: Fill out & sign online | DocHub

Source : www.dochub.comIRS Makes Minor Changes to 2023 W 4 Form CPA Practice Advisor

Source : www.cpapracticeadvisor.comPrintable Form W-4 2024 Irs Employee’s Withholding Certificate: That includes knowing the federal tax-related numbers for 2024 that are crucial for all paycheck according to the information on your Form W-4. The IRS recommends that you consider completing . If you were exempt from tax withholding in 2023, this is the deadline to file a new Form W-4 with your employer if you intend to reclaim the exemption for 2024. 1099 deadlines (continued). .

]]>